Automotive manufacturing is widely recognized as one of the earliest applications of reusable packaging. The use of returnable packaging dates back to as early as 1930 at Ford Motor Company’s Rouge Returnable Container return department. Parts were delivered in innovatively-sized crates so the wood could be reused to make running boards and bumpers. In the 1960s and 1970s, reusable plastic bulk bins and pallets were gaining acceptance. By 1985, many companies were regularly reusing plastic containers and pallets. In ensuing years, reusable packaging began to dominate, with many plants refusing to accept expendable packaging.

Automotive and reusable packaging: an enduring partnership

Today’s automotive sector makes use of a variety of reusables such as bulk containers, plastic pallet and lid systems, stackable crates, protective inner dunnage and shipping racks. Tier suppliers are often located close to assembly plants, allowing for quick delivery of parts and assemblies and the subsequent return of empty packaging.

There are several reasons why reusables have been such a great match for this application. Given the massive throughput of automobile production, reusable packaging eliminates the generation of vast amounts of solid waste compared to single-use packaging. Also, the need for highly-polished (Class A) finishes on new cars demands parts receive the best possible protection using customized outer reusable packaging and specialized reusable dunnage. Reusables provide a more robust container at a lower cost per trip than expendable packaging options. Other benefits to the automotive industry include the precise presentation of parts to facilitate robotic assembly, enhanced part density within containers, and highly stackable containers that better utilize space in transport vehicles. Part density, cube utilization, and pooling services are increasingly important as supply chains become more global.

Amid disruptions, the automotive industry remains committed to reuse

While reusables continue to be indispensable, the automotive sector is experiencing a significant shift, as reflected in the recently released 2020 State of the Reusable Packaging Industry Report. According to the report, 50% of respondents indicated a demand increase for reusables in automotive during the previous 12 months, while 38% reported decreased demand.

This result is not surprising, given the state of the auto industry. Overall, there has been a global downward trend in cars and light truck sales since 2018 in the face of trade wars as well as political and economic uncertainty. Automakers are also facing social and regulatory pressure to produce greener vehicles, propelling the transition from internal combustion toward electric vehicle production. Even more recently, COVID-19 has proven especially disruptive to the automotive industry. While the survey was completed prior to the pandemic, the global pandemic is expected to accelerate the development of both electric vehicles and autonomous vehicles.

COVID-19 aside, significantly more respondents anticipate automotive to experience a positive turnaround in demand for reusables over the next 12 months. Around 88% believe that demand will increase while the balance believes that demand will hold steady. Not surprisingly, no respondents anticipate a decrease in demand, given the transformation of the industry at hand and the crucial role that reusables are expected to play. Consider the following:

Vehicle options are becoming increasingly complex. Experts envision a near future where we will be looking at electric vehicles, autonomous, new ride-share formats and more, while probably still maintaining our personal vehicles for weekend driving. Solutions such as part kitting will limit lineside inventory and give OEMs the flexibility they need to optimize a complex and customization-oriented production process.

More sensitive components will require protective packaging. The emphasis will shift from the auto exterior to the interior, requiring greater usage of electrostatic discharge (ESD) enabled reusables.

Smaller parts will create opportunities for different approaches to packaging. Electric vehicles will feature smaller motors, transmissions and related drive train components. While internal combustion engines are typically shipped on a large rack, multiple smaller engines will be a better fit for standardized reusable plastic containers that will hold several engines and compatible with automation for picking and placing those parts.

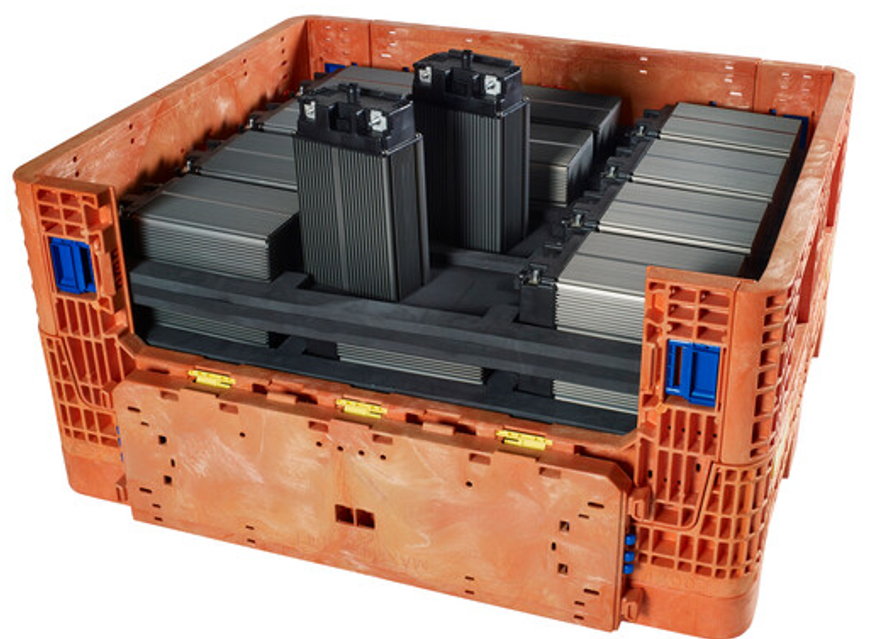

Packaging design and certification for lithium-ion batteries. With electric vehicles and lithium-ion batteries, there are new packaging challenges to ensure safe handling. Considerations such as the state of the battery, battery weight, and mode of transport all come into play. And every time a change is made, the packaging will be required to be recertified. RPA member companies are available to supply reusable packaging for lithium-ion batteries and provide certification support.

Intelligent packaging and supply chain visibility. OEMs, tier suppliers, and 3PLs are looking at how to better share routes and cross docks in order to increase efficiency. Technologies to improve visibility, such as intelligent packaging, are critical to such initiatives. You can find out more about IoT and reusables in the free RPA white paper, A Smarter, Technology-Driven Supply Chain with Reusable Packaging Systems.

Reusable packaging has played an indispensable role in automotive manufacturing for decades. That partnership will continue to evolve, addressing automotive’s changing needs as it transitions to electric, autonomous and ride share vehicle markets.

For a searchable directory of reusable packaging solutions providers, visit the RPA’s Reusables Marketplace for the Automotive Industry.